I like classic cars. To me they are rolling pieces of art, and the pinnacle of car shows is probably the Pebble Beach Concours d’Elegance. Several months ago an article featuring that show popped up in my timeline. It was by Michael Mechanic and it led me to his book Jackpot: How the Super-Rich Really Live – and How Their Wealth Harms Us All. It’s an entertaining and well-researched look into the lives of the very wealthy, and I highly recommend it to anyone interested in such things.

TLDR; This is a very long post containing lots of personal stories. Feel free to skip and just buy the book.

I grew up in a small town in North Carolina called Asheboro. I don’t really remember being exposed to very wealthy people back then. Of course we had our rich people, mainly business owners or doctors, and they lived up on Dave’s Mountain, or what we just called “The Mountain”. The poor people, mainly Black, lived in a section of town called “The Hill”. But in my solidly middle class neighborhood I don’t remember wealth really being a thing.

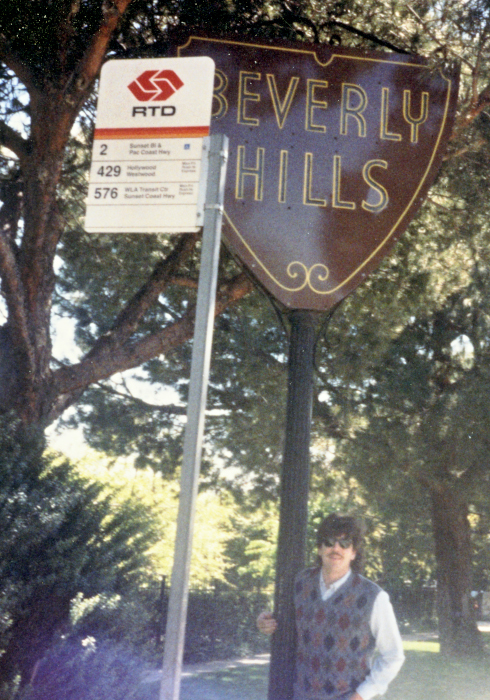

When I graduated high school I moved to Los Angeles to attend college. That was my first real contact with wealthy people. One of my friends was in a family that was considered one of the top ten wealthiest in the country, worth billions of dollars back in the early 1980s when a billion dollars meant something. My friend was very down to earth (he drove a ‘vette, a Chevette) and in the brief experience I had in his world I didn’t see much in the way of conspicuous consumption, it was more just the scale of things.

While I would get introduced to his friends wearing watches worth more than my yearly tuition, his house, while large, wasn’t extravagant, and the main difference between his bedroom and mine was the size (his was larger and had its own bathroom). He taught me a lot about how money worked in Beverly Hills, and the stratification even among the wealthy (the wealthiest families lived north of Sunset, and it went down as you moved south of Sunset, north of Whilshire and then finally south of Whilshire).

The school I was attending, Harvey Mudd College, was home to a lot of smart people, and several of my friends, upon graduation, moved to Seattle to work with this little start up known as Microsoft. Many of them are retired now, as they’d hit the jackpot. During the next few years Microsoft stock would split 8 times. So if you joined with, say, options on 1000 shares for one dollar, you now had 256,000 shares at 1/256th of a dollar per share.

The end of the 20th century was a lot like the end of the 19th century. In the latter businesses such as railroads and oil minted a large number of nouveau riche, and at the end of the former computers and the Internet did the same.

I was not one of them. However, even though I’m not in the 1%, or even the 2%, I have a number of friends who are and so I like to say I’m “1% adjacent”. I get to see some of the benefits and problems their wealth brings.

The title Jackpot refers to this, sometimes sudden, increase in wealth. The book starts off with an Introduction where we meet Nick Hanauer. In the early 1990s he put up $45,000 for a 1% stake in Amazon. As you can imagine, it is worth considerably more now. While Hanauer states he is “not a billionaire” he is worth hundreds of millions of dollars and unlike others who “spend the rest of their days trying to make their big pile of money even bigger” he wants to use his money for something more meaningful.

In addition to profiling the lives of the wealthy, the book aims to look at the social impact of wealth disparity. Most of the very rich are, indeed, focused on making themselves richer versus the improving society as a whole, and Jackpot examines the reasons why.

When large amounts of wealth is held in the hands of the few, it can lower the standard of living for the rest of the population.

As an example, when I was in primary school we learned about the difference between “mean” and “median“. If you have an array of values, the “mean” is the average of those values (add them up and divide by the number of entries). The “median” is the middle number of those values if they are arranged in order. For many distributions the mean and median are the same.

Suppose I have this series:

1, 2, 3, 4, 5

In this case the mean is “3” (15/5) and the median is also “3”.

But what if I change the last number:

1, 2, 3, 4, 10

Then the mean goes to “4” (20/5) while the median stays at “3”. The median is important in that it represents the value at which half of the samples are less and half are more. In many cases it is more representative of the “common” value than an average.

How does this relate to the super-rich? Well according to the Survey of Consumer Finances (SCF) by the Federal Reserve the median household net worth in the US was $121,411 in 2019. But due to the ultra-wealthy the average household net worth was $746,821, over six times greater. Looking at my simple example above you can imagine how skewed those top numbers have to be in order to cause such a difference.

One thing I love about Jackpot are the copious notes. I have pestered the author numerous times over the last few months to run down his sources that weren’t apparent from the appendices, and I like the fact that his book is well researched (and that Mr. Mechanic has been very tolerant of my pestering).

I can remember the Occupy Wall Street movement back in 2011 which was the first time I’d ever heard the term “The 1%”, referring to those people who are in the top 1% in net worth in the US. To many it means the very wealthy, but as we learn in the Introduction the bottom threshold for being in the 1% is $5.6 million (in 2019).

Being “1% adjacent” I can say that those who are just over that threshold aren’t the super rich. As Mechanic puts it “they are just 5 percenters with a nice house and a bigger security blanket”. My 1% friends don’t worry much about where their next meal is coming from or where they are going to live, but they aren’t out buying yachts. When we talk, the number one financial issue tends to be preparing for retirement. In North Carolina the average cost per person for assisted living is $45K/year, and by the time we reach the age where we might need it, it will be closer to $100K/year for a nice facility. Assume you might need it for 20 years and then you are looking at $2 million total, perhaps twice that for a couple. It takes a huge bite out of that $5.6 million.

When people think of “The 1%” I believe they are really referencing “The 0.1%”, which is a net worth of around $29.4 million. That’s when managing your money becomes a task in an of itself. It is above the level where you can avoid inheritance tax, and while you may have money worries retirement won’t be one of them.

The next tier is “The 0.01%” which has an ante of $157 million in net worth, where your wealth can take on a life of its own, and “The 0.001%” or the billionaires, even though admission to that club comes in at a paltry $800 million.

After the Introduction, the book jumps in to the idea of hitting the jackpot, which can take many forms. Most of the people I’ve know who have hit the jackpot have been in tech, or they’ve owned businesses that are related to tech, but you can hit the jackpot by winning the lottery or getting an unexpected inheritance. They all come with their own set of problems, but the common theme is going from “normal” money to crazy money. Apparently you end up with a lot of new friends when that happens, as well as relatives you never knew you had.

I have to admit that I play the lottery, but I have a particular rule. I can only spend $1 for every $100 million in jackpot prize money. Since the minimum ticket price for Powerball or Mega Millions is $2, I don’t play unless the jackpot is at least $200 million.

That limits how often I play but also gives me a certain level of entertainment. The odds of choosing the winning numbers in Powerball, for example, are over 292 million to one (close to picking a particular American adult out of the total population). The minimum jackpot is $20 million but to be honest even though $20 million would be life changing, it isn’t as life changing as $200 million (sort of like the difference between the 1% and the 0.01%). Part of my lottery fantasy involves calling my lawyer, who would assist in helping us remain anonymous. Another part involves hiring an Air Force friend of mine to pilot my private jet (grin).

Which leads us to the next section of the book, which is what to do with all this money. Of course the ultra-rich are known for owning multiple houses, exotic cars and boats, but what is funny is that extravagant spending on items is not common among my wealthy friends. They tend to be much more frugal, and when they spend money they spend it on experiences.

A couple of things to unpack here. When it comes to cars, as much as I love nice cars the most we’ve ever spent was $52K on a new Lexus, back in 2010. I really like getting a deal, and there are some amazing deals to be had in the secondary car market. I’m addicted to a website called Bring a Trailer, which is where I bought my 2003 Mercedes SL55. It was $129K new (or $183K in 2021 dollars) and I got it for just over $30K. Now $30K isn’t chump change but considering a new Camry will cost more it is a bargain. On Bring a Trailer I’ve seen pristine Bentley’s go for $50K as well as nice Aston Martins. Of course someone just bought an Integra for $112K so not everything is at the bottom of the depreciation curve, and now people who were kids in the 1990s have the wealth to buy the cars they wanted when they were young.

Even where I live in rural North Carolina it isn’t rare to see a high end BMW, or a Tesla Model S on the road, both $100K+ cars, but there would be a social stigma associated with driving, say, a Ferrari around town. A new Corvette or a high end pickup, sure, but conspicuous consumption is frowned upon.

I’m reminded of an apocryphal story about Rolls-Royce. In the late 1970s the company was not doing well, surviving mainly on its airplane engine business. In the car business they were seeing increased competition from competitors like Mercedes and BMW. The new Rolls-Royce CEO’s course of action was to triple their prices. Demand shot through the roof. While certain rich people could afford a $80K car, only the most wealthy could buy a $240K car. In microeconomics when demand goes up with price it is called a Giffen Good and these always reflect value external to the good itself, such as being able to broadcast one’s wealth by what car you drive.

It’s not all happiness, though. One friend of mine bought a McLaren. He loved the beauty of its engineering but the darn thing often wouldn’t start. He seemed really happy when he sold it.

The second thing to unpack is that another way to spend money is not on things but on experiences. Seen all those multi-millionaires going into to space?

Even my frugal rich friends are prone to spend more money on a prime experiences than on a nice thing. This reminds me of another great book called Happy Money that did research showing that the happiness that people get from buying things tends to fade a lot more quickly than the happiness they get from an experience, especially if that experience involves some form of anticipation.

Being 1% adjacent I’ve been able to experience some things the wealthy take for granted. I like fine dining, and years ago I was able to eat at my first and only Michelin three-star restaurant, the Alinea in Chicago. At around $600 per person, including wine paring, it isn’t cheap, but I thought the experience was worth every penny. Note that for me this is a once in a decade thing.

The other thing the very wealthy do is take elaborate vacations. Again, I don’t have the means to copy them but I did travel a lot for work, and using points and miles earned from that travel we have been able to experience how the other half lives. We’ve stayed in high end hotels in numerous countries and we get there flying either business or first class, but that involved a lot of planning and the judicious use of said points and miles.

For example, we had the desire to visit New Zealand. Using my American Airlines miles we got business class airfare but part of the trip was on Air Pacific (now Fiji Airways) and it took us through Nadi, Fiji. We decided to spend a few days there on a layover, and I found an amazing resort called Navini Island. It looks like the all-inclusive resort now runs a little over US$500/night but when we went it was less than $400/night per couple.

Meanwhile, there is another resort in Fiji called Turtle Island. While Navini is very small, about 6 acres, Turtle Island is 500 acres and was the site of the 1980 film The Blue Lagoon. Although I can’t find a current cost online I remember it running around five times that of Navini, more like US$2500/night per couple.

The reason I bring this up is that I first heard of Turtle Island from a 2008 blog post [link currently broken] by Scott Adams, the creator of Dilbert. He went there and had an amazing time, but I couldn’t understand what would make it five times better, so I sent him an e-mail asking his thoughts. He wrote back “I wasn’t in charge of Fiji island picking but it was worth the money.”

My guess is that at his wealth level the difference didn’t matter as much as it would to someone like me.

However, one of the nice things about being 1% adjacent is that sometimes it doesn’t cost me anything to take a vacation. Several years ago we went to Chicago. When I mentioned to a friend of mine who lived there that we were coming, he was like, hey, I’ll be out of town that weekend, why don’t you stay in my luxury high-rise apartment? So for the cost of an hour or so cleaning up after our visit and a nice bottle of tequila as a thank you gift, we got to stay in an amazing place costing thousands of dollars per month.

In another instance I was going to London on a business trip. I had another friend who had a Council Flat outside of Borough Market, but when I was going to be in town her and her husband were staying at their place in Paris. They offered to let me stay in their flat for the cost of a cleaning fee, about £50. Much less than the cost of a hotel and it was a nicer experience being in a neighborhood in London than in a city hotel.

This is another thing that is brought up in Jackpot. Rich people tend to have rich people friends, and so they often don’t have to spend much to take a vacation. Bill might want to visit the Maldives so he just stays at Jeff’s place, and when Jeff wants to take a vacation he might crash at Bill’s place in the Caymans.

One place where the rich are different from others is in their houses. If you want to buy a $400K car you can’t just park it on your suburban street, and expensive houses tend to clustered with other expensive houses. One thing these high-end neighborhoods pride themselves on is privacy, but another way to look at it is isolation.

In the firmly middle class neighborhood where I grew up, everyone knew everyone else. If I happened to be at Alan Bass’s house at lunch time, his mother would feed me. The same as if he were at mine, my mom would feed him. I can remember riding my bike down our hill at speed and I wrecked trying to take a corner (I think I was around five). I crashed in Archie Farley’s yard, who taught physics at the local high school, and he came out, calmed me down and took me home. I’m not sure this would happen in a rich neighborhood, or if such play would even be allowed.

Mechanic talks about the effect this has on the rich, and how things like houses turn into a competition with one’s neighbors. As Sam Polk states in the book “Most of the search for wealth is not about how good the stuff is. It’s about what the stuff says about how valuable a person you are.”

Now once you have the house and car, what else could you want? How about attention. Of course all this money isn’t worth anything if you aren’t around to enjoy it, so you need to stay healthy. The rich have access to all sorts of concierge level medical care that the rest of us couldn’t afford.

I have some friends who used to get yearly checkups at the Mayo Clinic. These were two-day “head to toe” affairs where all aspects of their health were evaluated. One thing they really liked about the service was that each different physician they saw shared information, so there were few forms to fill out and little repetition. If you are rich your time is important.

When I was in college hanging with my friend with the ‘vette, he told me that in addition to the green, gold and platinum AMEX cards that there was a special “black” card for the ultra-wealthy. At the time it was an urban legend, but in 1999 they decided to make it a reality with The Centurion Card. This invite-only card apparently gets you access to amazing concierge services. No one knows what it takes to get an invite, but I had a friend who spent $35K/month for years on his AMEX card and didn’t get one.

The second part of the book focuses on various aspects of being super-wealthy. In many cases it is driven by the desire to keep up with your peers.

At some point, your wealth requires both people to manage it and to isolate you from people who would seek you out in the hope of getting some of it. Can you trust the people who manage your money? One of the things that stuck out about this part was that people I know in the 1%, but not the 0.1%, are often affected by things out of their control but they don’t have the resources to, say, hire lobbyists to get it addressed. One recent change to the tax code involving foreign assets has a friend of mine looking at spending $250K just to properly file their taxes and that isn’t a negligible amount to them.

Tax law often has unexpected consequences. When it was made mandatory that public corporations report executive compensation, the idea was that by making it public it would shame them into keeping such compensation modest. The exact opposite happened, and executive compensation skyrocketed. From the book:

In 1965, according to the Economic Policy Institute, the CEOs of the 350 largest public companies collected about twenty-one times as much compensation as the typical worker, on average. That’s a big difference, but people could still relate to one another. As of 2019, the ratio was 320-to-1.

Another issue facing the rich is interactions with those who have less than them. Being 1% adjacent I seem to be able to get along well with those both above and below my economic bracket, but I can remember one embarrassing mistake I once made.

We were out with another couple who we hadn’t seen in awhile, and we all liked good food. We were at a high-end Italian restaurant and we were getting treated very well, since I had been introduced to the owner through one of his relatives I knew from one of my customers. We had a long meal with several courses and a number of bottles of wine.

When the check came I just suggested we split it, as this is very common among my friends as it makes things simple. I realized my mistake the moment the words came out of my mouth, judging from their expression. I had forgotten that this other couple didn’t make as much money as we did. They were both in very respectable positions but some of those don’t pay as much as a job in tech. But once the words were out I couldn’t take them back. I should have at least offered to pay for the wine, since it was my idea to order most of it. I felt horrible.

I later made it up to them by taking them out to an even nicer restaurant and insisting on paying, but I can’t help but wonder if they had to do without something because of that first meal we shared.

Jackpot also talks about issues around romance and security. If you are wealthy and single, how would you know if someone was interested in you and not just your money? Most of the rich people I know found their partners before they became rich, but one multimillionaire I’m acquainted with has just decided never to get married because they simply can’t tell.

With respect to security, I knew a person who was working with a billionaire and brought him a small, wrapped gift, which he put down on the conference table they were using. Very calmly one of the billionaire’s security team discreetly picked it up to be opened and examined later.

In 1994 a rather controversial book called The Bell Curve was published that showed how society filters people out by cognitive ability. The first separation is between those people who finish high school and those that don’t, followed by people who go to college versus those who don’t. College students are further filtered by which schools they attend. One statistic, that I’m quoting from memory, was that if you distributed people with a Ph.D. degree throughout the population, the average person would know about two. I can name twenty without straining very hard.

The same thing happens to rich people, especially their children. They go to private schools with other rich people’s kids, and then on to elite colleges and universities, thus often isolating them from people who aren’t rich. Plus, when it comes time to enter the work force, they have the connections to get those high paying jobs.

And what about the security of those children? While you might think the worst thing upon hitting the jackpot would be a shirttail relative hitting you up for money, what if a not so nice person wants access to your money through kidnapping.

Being the child of rich parents has its own problems. One often associates drug use with the poor, but one study of 1800 students in Texas found that 30% of both the richest and the poorest kids reported using drugs, compared to 18% of the middle income students.

As I don’t have offspring, the sections on the issues rich people face with respect to caring for their children as well as passing on wealth were interesting, but didn’t really resonate with me. However, at the end of Part II Mechanic begins to address how this wealth inequality affects society. One paragraph I highlighted

Successful people tend to feel deserving of their lot, research suggests, regardless of whatever advantages they may have enjoyed in life. As a corollary, they tend to view less fortunate people as having earned their lack of success. “So you’re more likely to make sense of inequality,” Piff explains, “to justify it, make inequality seem equitable”

The “Piff” in the above quote is researcher Paul Piff, who sometimes uses the game Monopoly to explain wealth disparity. People who lose at Monopoly tend to blame it on bad luck, whereas winners often brag about their superior strategy. Even though the game is heavily skewed toward random events, winners feel that they have earned their win.

I was exposed to this a lot growing up. Poor people were poor because they were lazy, not because of external factors.

Being a member of the oppressive color, language, age and gender, I was a beneficiary of the American Dream. My grandfather worked in a coal mine and died of Black Lung Disease when my father was 17. My father grew up in a four room house, not a four bedroom house, and supported his family by taking an apprenticeship at Westinghouse and attending night school at the nearby university. His seven year journey to a degree was broken up by a stint in the Reserves. To say he worked his ass off is an understatement, but that allowed him to to get a good job in manufacturing and to provide a nice existence for my mother, my sister and myself.

I used my middle class security to get options not available to everyone else. I was lucky enough to attend the NC School of Science and Math for high school, and that allowed me to get into good colleges. I didn’t do very well in school but I had a safety net in my family that did eventually see me graduate, and later in life my ability to take risks allowed me to start my own company which was sold two decades later for a modest, but not insignificant, payday.

Success is often a combination of hard work and a lot of luck.

The final section of the book talks about how wealth inequality skews the game in favor of the wealthy, and how wealth is skewed toward those in the highest percentile (remember my mention of median vs. mean wealth above). Wealth grants you access to politicians, who can, in turn, help protect and increase that wealth.

As someone who lives in the South, I am surprised at how many people vote for politicians who don’t have their best interests at heart. I think, in part, it is this myth that with hard work anyone can join the 1%, and in turn the 1% can join the 0.1%.

I can remember during the Obama administration he worked to implement tax cuts for the middle class. As I was driving to the office one day I got behind a dually pickup truck that had one a sticker saying “I’ll keep my guns, my money and my religion, and you can keep ‘the change'”.

This was an obvious criticism of Obama, and when I got closer I saw that the truck belonged to the owner of a local RV park. I couldn’t help but think that I probably paid more in taxes than this guy made that year, but he was of the opinion that Obama’s policies would hurt him.

The differences in wealth distribution are staggering. In 2019 if you were in the 90th percentile (the top 10%) you had an average individual (not family) net worth of $2.8 million. For the 80th percentile that dropped to $555K, for the 70th it was $293K and for the 60th percentile it was $152K. At the 24th percentile your net worth was around $199 and it quickly drops below zero after that.

Often when talking about wealth, annual income is referenced along with net worth. To be in the 1% you need to have an annual household income of around $481K per year (in 2019). I always discount that as I know a number of people who work in Silicon Valley who make very high salaries but due to the cost of living have little net worth. If those people can’t manage to generate wealth I think it would be very difficult for someone making a lot less to manage it, but there is still that dream.

The dream is perpetuated by any number of “wealth gurus” who promise riches to those who pay to attend their seminars. They fuel “false beliefs about wealth and mobility” that all you need to do to become wealthy is work hard. One of my favorite quotes from the book:

Anyone who builds a company works their tail off. But some founders are more clear-eyed than others. Jerry Fiddler worked one-hundred-hour weeks at Wind River Systems, but “anybody who tells you that they are wealthy because they work harder is either lying to you or they’re lying to themselves. My cleaning lady works harder than I do and doesn’t make as much money,” he told me. “The work is necessary, but it’s not sufficient.”

The book also addresses the differences in wealth and race. I found this particularly interesting considering the current outcry against Critical Race Theory (CRT). When the whole CRT outrage popped up a few months ago, I had never heard of it, so I did a little research. It is a bit esoteric, being a subject taught in graduate level law programs for those who are seeking a doctorate in jurisprudence, and isn’t a common subject for most law students. My interpretation of CRT is that, since there are no significant genetic differences between White people and people of color, the differences in outcomes concerning wealth and influence must be due to something else.

That’s it.

Seems pretty straightforward, right?

I think part of the furor over CRT comes from this idea people have that the playing field is level for everyone and they “earned” their wealth through hard work, not realizing the indirect help they had along the way. I’ve worked very hard in my life, as did my father and his father, but we all had certain advantages that created an atmosphere where we could succeed. From the book:

“I run on the beach,” Paul Piff told me by way of illustration. “Some days I feel like I’m going particularly fast, and on those very same days, when I’m coming back, I feel like, ‘Whoa, that is a heavy wind and it’s making me go slower.’ I didn’t realize when I was going fast that there was wind pushing me.”

When people claim that race makes no difference in the US, all you have to do is look at the nation’s billionaires. In 2020 there were 788 of them, and considering the population of the US is 13.4% Black, we should have 105 Black billionaires.

There are seven.

Every week I meet up for lunch with some gentlemen who call themselves “The Old Farts Club”. Most are in their 70s and 80s, and in the past were involved in local politics. One week I brought up the idea of reparations, meaning a one time monetary payment to descendants of former slaves as restitution. I haven’t made my mind up on whether or not this is something we, as a society, should do, but as an extreme extrovert I tend to do my thinking out loud.

So I decided to do the math, but I had a lot of trouble finding consistent numbers for household wealth (or even the number of households). Using the numbers from the book, the median net worth of White US households is around $171K, and for Black households $17K, for a difference of $154K. So I asked myself, what would it cost?

The next step would be to determine the number of Black households in the US, and I get values from 10 million to 15 million. Taking the average, 12.5 million, I come up with $19.2 trillion, which is less than the current US debt of $28 trillion (as I post this) but it is still an astronomical number that illustrates the impact race has on wealth in this country.

Another minority impacted when it comes to wealth are women. Even though they make up more than half of the population, they only represent 7.4% of the CEOs in the Fortune 500. There are a number of reasons for this. It was mentioned that one way to financial success is to go to the right college, but the Ivy league schools were some of the last to go co-ed. Also, a lot of people who hit the jackpot do so in tech, and tech is a male dominated field (think of the “tech bros“). The irony is that evidence suggests that women make “superior stewards” of wealth but they are often excluded from the top ranks of finance.

The final part of the book talks about the options the rich have for giving away their wealth. There is a lot to consider, including how much to leave to family and deciding which organizations should get those funds. The Giving Pledge is a promise by some of the world’s wealthy to give away half of their fortune either during their lifetime or before they die.

I have spent a lot of time thinking of the impact the ultra-rich could have if they decided to part with even a fraction of their wealth.

I have a friend who is a policeman in Durham, NC, and I occasionally go on ride-a-longs with him. On one of those he had to respond to a shooting at McDougald Terrace (known locally as “The Mac”), a housing project that evokes Chicago’s Cabrini Green and is home to around 300 families. There have been a lot of issues with the buildings, and there is a plan underway to renovate them, at a cost estimated to be near $20 million.

While that is a lot of cash, it’s “lunch money” to those worth hundreds of billions. Bill Gates once said he could spend $3 million a day, every day, for 100 years and not run out of money, and that assumes he doesn’t make another cent.

As you can probably guess, I really enjoyed this book, and I don’t read much non-fiction. When I was in school I studied Spanish, and with that came the study of countries that speak Spanish as their primary language. A lot of them, especially in the western hemisphere, have not been very politically stable. My teacher pointed out (in the late 1970s) that the reason these countries have such issues and the United States doesn’t has nothing to do with language but instead it is because the US has a large middle class. In countries where wealth is hoarded by the few, that wealth tends to get redistributed by revolution. But the middle class is shrinking which doesn’t bode well for the continued stability of the United States. The first step in stopping this is understanding why, and this book is a good start.